Choosing the right ETFs can be a game-changer for investors looking to balance risk and reward while diversifying their portfolios. With a plethora of options available, identifying the best-performing ETFs requires analyzing their past performance, expense ratios, future growth potential, and current holdings. In this guide, we rank five popular ETFs from best to worst, offering insights into their strengths and weaknesses to help you make informed investment decisions.

The five ETFs we will be discussing are:

- SCD (Schwab U.S. Dividend Equity ETF)

- QQQ (Invesco QQQ ETF)

- VGT (Vanguard Information Technology ETF)

- JEPI (JP Morgan Equity Premium Income ETF)

- ARKK (ARK Innovation ETF)

Understanding ETFs and Diversification

ETFs (Exchange-Traded Funds) offer a great way to diversify portfolios across different asset classes. While most ETFs focus on stocks, financial experts recommend diversifying investments beyond traditional stock-bond frameworks to include alternative assets. Recent reports highlight the growing potential of assets like blue-chip contemporary art and collectibles as part of a diversified investment strategy.

Ranking ETFs from Worst to Best

1.ARKK (ARK Innovation ETF) – High Volatility, Low Consistency

- Ticker Symbol: ARKK

- Expense Ratio: 0.75%

Top Holdings: Tesla, Roku, Coinbase, Roblox, Palantir, Shopify

ARKK, managed by ARK Invest under Cathie Wood, is known for its focus on high-growth, disruptive companies. Despite showing impressive gains during the pandemic, ARKK’s long-term performance has been inconsistent. Since its peak in February 2021, the ETF has lost nearly 60% of its value, significantly underperforming the S&P 500, which has gained nearly 60% over the same period.

The ETF’s high volatility and expensive 0.75% expense ratio make it an unfavorable option for long-term investors. Given these factors, ARKK ranks last on our list.

Also Read Top 5 Stocks to Supercharge Your Portfolio in February 2025

2.JEPI (JP Morgan Equity Premium Income ETF) – High Income, Limited Growth

- Ticker Symbol: JEPI

- Expense Ratio: 0.35%

- Top Holdings: Meta, Amazon, MasterCard, Visa, Alphabet, Thermo Fisher

JEPI is an income-focused ETF that uses an options-based strategy, particularly covered calls, to generate high monthly dividends. While this strategy provides consistent income, it also caps upside potential. Over the past year, JEPI returned only 5%, significantly underperforming the S&P 500’s 25% gain.

For investors looking for stable income, JEPI is a great choice. However, for those focused on growth, it may not be the best option.

Also Read 7 Stocks Poised for Major Gains: A Deep Dive into High-Growth Investments

3.VGT (Vanguard Information Technology ETF) – Strong Tech Exposure

- Ticker Symbol: VGT

- Expense Ratio: 0.10%

- Top Holdings: Apple, Nvidia, Microsoft, Salesforce, Cisco, Oracle

VGT is a great ETF for those wanting technology exposure. The ETF has assets under management of $99 billion and has outperformed the market, returning nearly 100% since 2023 compared to the S&P 500’s 60% gain. However, it lacks diversification beyond tech and does not include major players like Amazon, Meta, and Alphabet.

While VGT is a solid choice for tech-heavy investors, those seeking a more diversified approach may want to consider alternatives.

Also Read 5 Best Mid Cap ETFs to Invest in Mid Cap Stocks in 2025

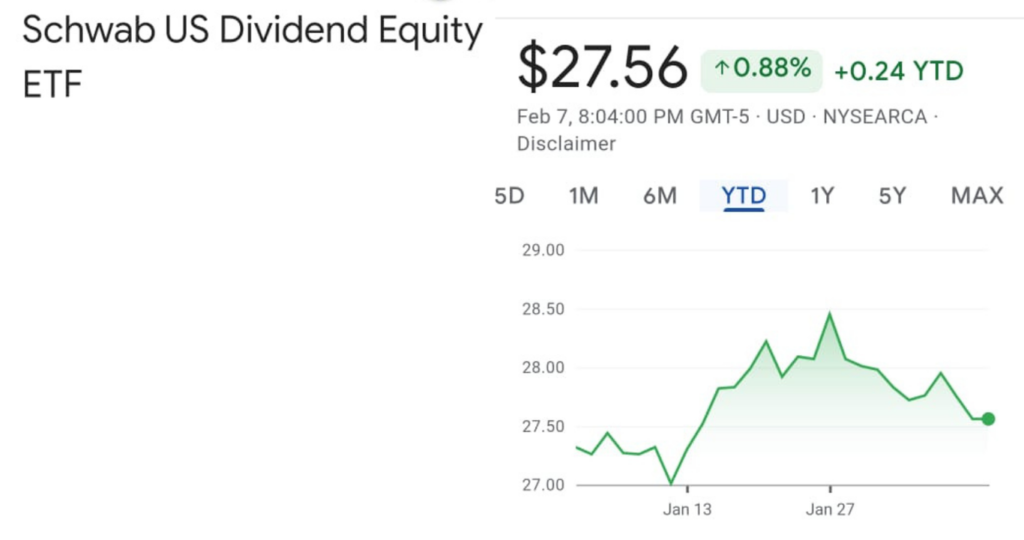

4.SCD (Schwab U.S. Dividend Equity ETF) – Best Dividend ETF

- Ticker Symbol: SCD

- Expense Ratio: 0.06%

- Top Holdings: AbbVie, Pfizer, Amgen, Cisco, Coca-Cola, Home Depot

SCD is a top-tier dividend ETF with a low expense ratio of 0.06%. Over the past year, SCD returned 9%, but its long-term value lies in its strong dividend growth, yielding 3.66% with a 5-year dividend growth rate of 12%.

While it lacks strong tech exposure, SCD is a great option for stability and consistent income. It remains one of the best dividend-focused ETFs on the market.

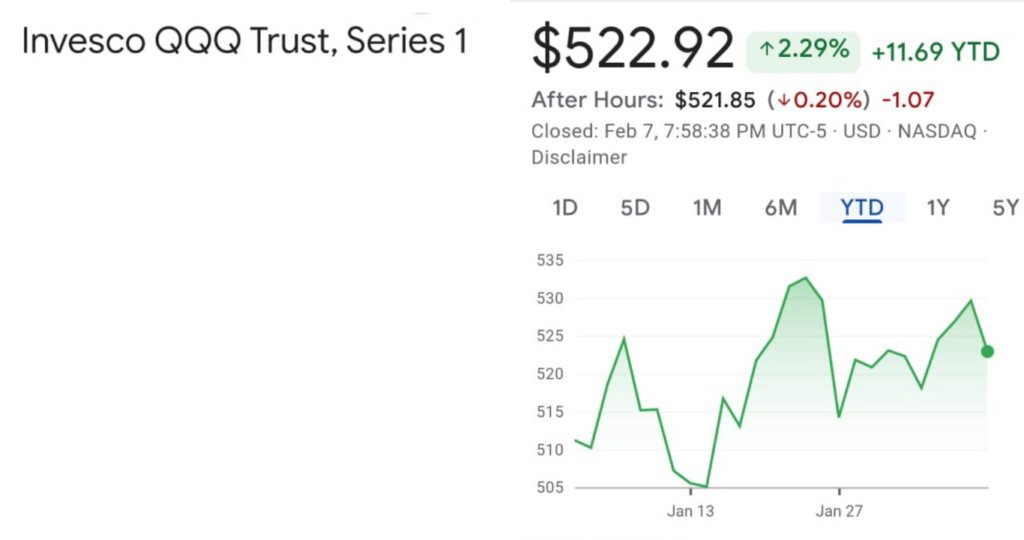

5.QQQ (Invesco QQQ ETF) – The Best All-Round ETF

- Ticker Symbol: QQQ

- Expense Ratio: 0.20%

- Top Holdings: Apple, Microsoft, Nvidia, Amazon, Meta, Tesla

QQQ offers an ideal balance of technology and diversification, with 50% tech exposure and the rest spread across other sectors. With $330 billion in assets under management, QQQ has returned 24% over the past year, making it one of the strongest performers.

Investors seeking exposure to top-performing companies with long-term growth potential should strongly consider QQQ. It’s also a preferred ETF for options trading, making it a great choice for active traders.

Final Thoughts

Here’s a quick recap of how these ETFs ranked based on performance and investment potential:

- QQQ – Best overall ETF for growth and diversification

- SCD – Best ETF for dividends and income stability

- VGT – Great for focused technology exposure

- JEPI – Ideal for income-focused investors but limited growth

- ARKK – High risk, volatile, and inconsistent returns

Each investor’s strategy will differ based on their risk tolerance, goals, and time horizon. If you prioritize growth, QQQ or VGT are excellent choices, while dividend investors may prefer SCD or JEPI.

Which ETF Do You Prefer?

Let us know in the comments how you would rank these five ETFs and if you agree with our list. Don’t forget to like, share, and subscribe for more investment insights!

Disclaimer

This article is for informational purposes only and should not be considered financial advice. The opinions expressed are based on personal analysis and research. Always conduct your own due diligence before making investment decisions. Consult with a financial advisor to ensure any investment aligns with your individual financial goals and risk tolerance.