Every Monday at 9:00 a.m. Eastern, Joseph Hoger from TI Nation delivers the stock market insights you need. Last week’s market turbulence shook AI and hardware stocks, but amidst the selloff, one sector stood tall cybersecurity. As AI-driven threats surge, cybersecurity stocks continue their upward trajectory, making them a compelling investment opportunity.

Cybersecurity: The Unstoppable Growth Trend

With a 20-fold increase in cyber threats over the past decade, the cybersecurity market has already reached a staggering $116 billion. AI’s impact on cyberattacks has accelerated growth projections, with the industry expected to reach $250 billion by 2029 a 21% annualized increase. Even the widely discussed AI platform, Deep Seek, faced a large-scale cyberattack just hours after shaking the market.

Amidst these challenges, cybersecurity stocks remain resilient. Over the past three years, the top cybersecurity stocks have delivered a 45% annualized revenue growth, outperforming most tech giants except Nvidia. While valuations remain high, waiting for a dip may mean missing out on long-term gains.

Five Cybersecurity Stocks to Buy Now

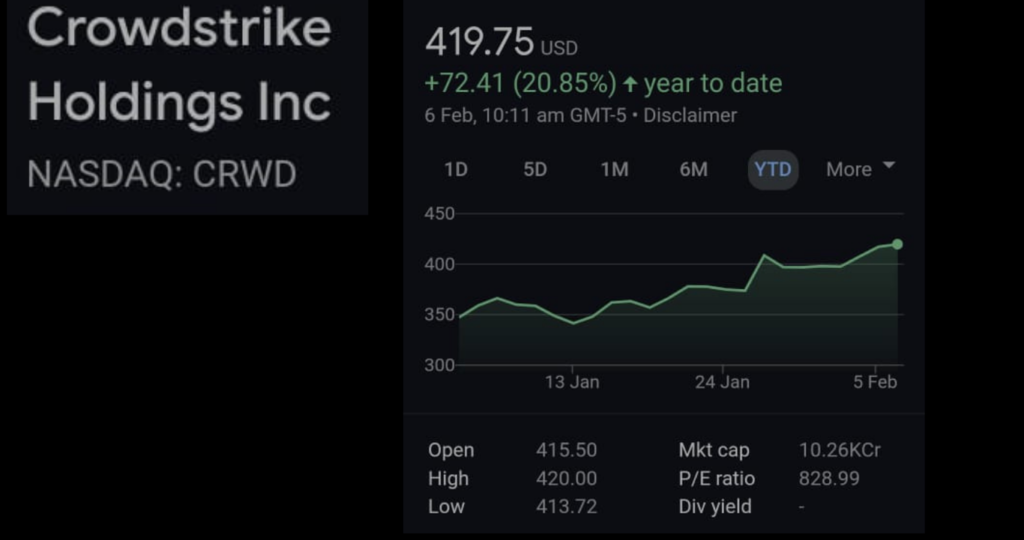

1.CrowdStrike Holdings (CRWD)

CrowdStrike has consistently demonstrated strong revenue expansion, driven by its market-leading cybersecurity solutions. Over the past three years, the company has maintained a robust customer acquisition rate, expanding its client base across multiple industries, including finance, healthcare, and government sectors.

- Investment: $119,000 (300 shares)

- Growth: 51% annualized revenue growth

- The company’s subscription-based revenue model provides a stable and recurring income stream, ensuring long-term profitability. With an increasing number of enterprises prioritizing cybersecurity, CrowdStrike’s revenues are expected to continue their upward trend.

- Competitive Edge: Falcon platform and AI-driven cybersecurity solutions

- CrowdStrike’s Falcon platform leverages advanced AI and machine learning to detect, prevent, and respond to cyber threats in real-time. The cloud-native nature of the platform ensures seamless scalability, making it a preferred choice for businesses of all sizes.

- The company continuously innovates its product offerings, integrating advanced threat intelligence and zero-trust security frameworks to stay ahead of evolving cyber threats.

- Recent Jump: 8% surge following top scores in SE Labs testing

- CrowdStrike achieved a 100% detection and protection accuracy rating in the latest SE Labs endpoint detection and response (EDR) test, reinforcing its reputation as a leader in cybersecurity.

- This validation has boosted investor confidence, contributing to the recent surge in stock price.

2.Palo Alto Networks (PANW)

Palo Alto Networks (PANW) is a leading global cybersecurity company that provides next-generation firewalls, advanced threat protection, and various other security solutions for enterprises, service providers, and government agencies. Founded in 2005 by Nir Zuk, Palo Alto Networks has grown to become one of the most well-known cybersecurity firms, offering products that protect against a range of security threats, including cyberattacks, malware, and data breaches.

- Investment: 200 shares, up 18% since purchase

- Market Position: Largest pure-play cybersecurity firm

- Customers: Over 655,000

- Valuation: Among the cheapest in the group at 50x earnings

3.Zscaler (ZS)

As cybersecurity threats continue to rise, businesses are increasingly adopting cloud-based security solutions to protect their networks. Zscaler (NASDAQ: ZS) is one of the leading cybersecurity companies specializing in Zero Trust Architecture (ZTA), offering innovative cloud security solutions to enterprises worldwide. With the shift to cloud computing and remote work, Zscaler has positioned itself as a strong growth stock. In this post, we will explore Zscaler’s stock performance, financials, growth potential, and risks to determine whether it’s a good investment.

- Investment: $60,000 (300 shares), up 177%

- Innovation: Pioneered zero-trust cloud security

- Revenue Growth: 43% annualized over three years

- Partnership: Collaborating with CrowdStrike for AI-powered security solutions

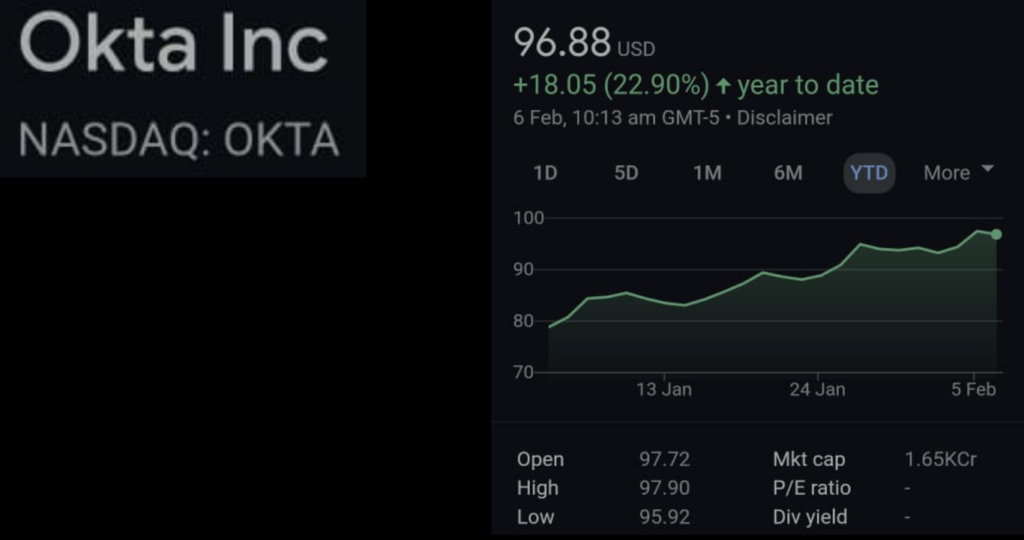

4.Okta (OKTA)

As businesses continue their digital transformation, the need for secure and efficient identity management solutions has surged. Okta (NASDAQ: OKTA) is a leading identity and access management (IAM) provider that helps organizations securely connect employees, customers, and partners to their applications. With the increasing focus on cybersecurity and digital identity, Okta has emerged as a key player in the industry. In this post, we will analyze Okta’s stock performance, financials, growth potential, and risks.

- Industry Leader: Identity management solutions

- Customers: Over 19,000 clients

- Retention Rate: 108% dollar-based net retention

- Acquisition Potential: Valued at $16 billion, could be a prime M&A target

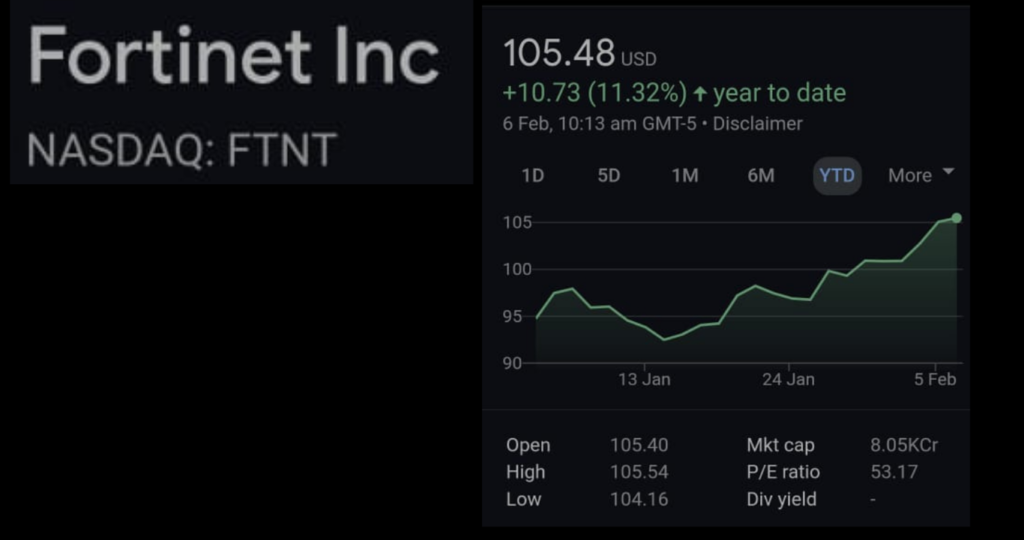

5.Fortinet (FTNT)

As cyber threats become more sophisticated, enterprises require robust network security solutions to protect their digital assets. Fortinet (NASDAQ: FTNT) is a leading cybersecurity company that provides cutting-edge firewall, intrusion prevention, and endpoint security solutions. With the rise in cloud computing, IoT, and hybrid work environments, Fortinet has emerged as a critical player in network security. This post examines Fortinet’s stock performance, financials, growth potential, and risks.

- Business Segments: Network security, operations, and SASE

- AI Utilization: AI-driven threat mitigation for reduced costs

- Profitability: Most profitable cybersecurity firm

- Investing in Cybersecurity: ETF Alternative

For diversified exposure, investors can consider the First Trust Cybersecurity ETF (CIBR), which has returned 111% over five years. However, while it includes pure-play companies like CrowdStrike and Palo Alto, it also holds tech giants like Cisco and Broadcom, diluting its focus on cybersecurity.

Stock Market Outlook and Sector Performance

While tech stocks have struggled in early 2025, the broader market remains strong. Consumer discretionary, financials, and healthcare sectors have posted gains. However, investors should remain vigilant historical market crashes, from the dot-com bubble to the 2008 financial crisis, began with selloffs in leading sectors before spreading market-wide.

Conclusion: Navigating the Market in 2025

Cybersecurity remains one of the strongest investment themes, with industry leaders delivering impressive growth. With increasing AI-driven threats, this sector is set to expand rapidly. Meanwhile, undervalued AI chip and logistics companies like AMD and Symbotic present compelling opportunities.

Stay ahead of the market subscribe to our updates and leverage Seeking Alpha’s premium research for exclusive insights into top stocks and market trends.